Steps to Begin

If you’re ready to file a weekly continued claim for Unemployment Insurance Benefits, click on the "LOGIN NOW" button. If you need instructions, please refer to the step-by-step guide below.

What you should have ready:

- User ID for Workforce Connect

- Password for Workforce Connect

- Information on hours worked in the prior week

- Gross earnings from the prior week

Step By Step Instructions

How to File your Weekly Continued Claim

Watch as we show you a step by step process on how to file your weekly continued claims.

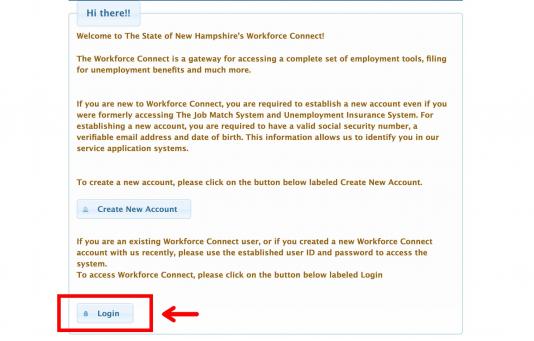

Step 1: Login

From this welcome screen, you will need to click on “Login” at the bottom of the page. You will need your User ID and Password from your Workforce Connect account to file your Continued Claim.

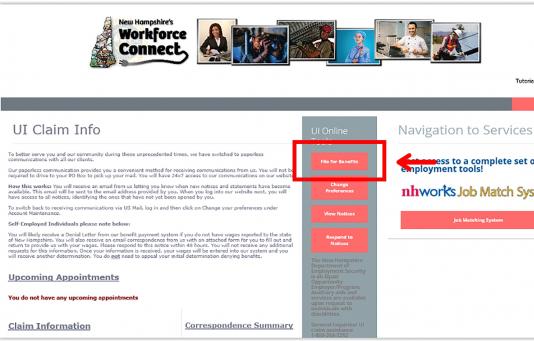

Step 2: Select “File for Benefits” on The Dashboard

You will be taken to the Workforce Connect dashboard. From here, you will select “File for Benefits” to submit your Continued Claim.

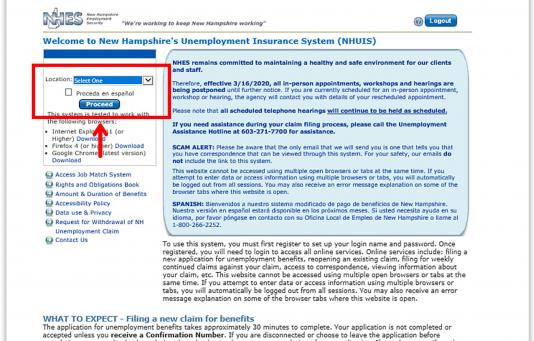

Step 3: Select Your Location

Next, you will land on the “Unemployment Insurance System (NHUIS)” page. From here, select the location from the drop-down menu on the left and then select “Proceed.”

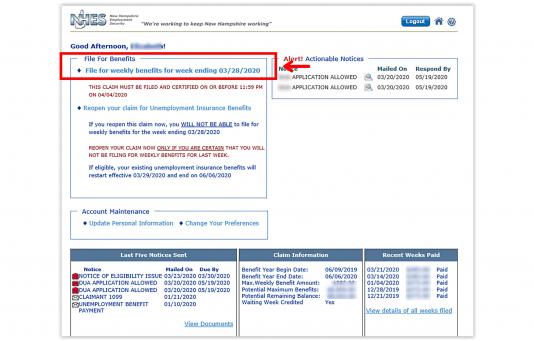

Step 4: Click the link “File for weekly benefits for week ending…”

Now, it’s time to file your Continued Claim. Under “File For Benefits,” select “File for weekly benefits for week ending …”

Note: This page is also full of valuable information. You can see the last five notices sent to you, claim information such as your benefit year and weeks that have been paid. You can also update your name and address and change your preferences.

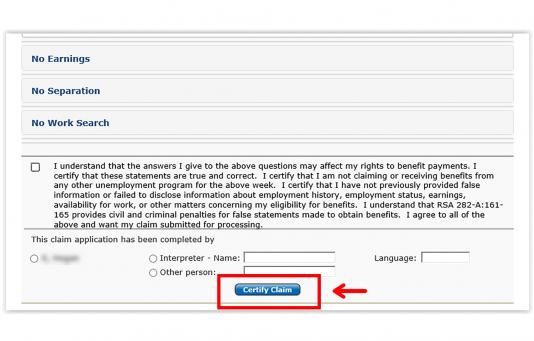

Step 5: Weekly Claim

When filing your Continued Claim, please read each of the questions carefully. When you are done, make sure you read this statement in full, then select the option under who completed the application and select “Certify Claim.” Congrats! You are done until next week. You can choose to print on the next screen.

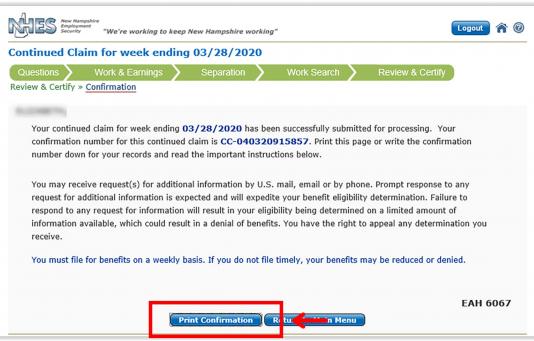

Confirmation

This is your confirmation page that indicates your weekly claim has been submitted. Click the "Print Confirmation" button at the bottom for your records.

Frequently Asked Questions

- I need help finding a new job. What are the resources available to me through the state?

- Weekly Work Search Requirements

- I work for a school. Am I eligible for unemployment benefits?

- Why does it say ‘Pay held’?

- What if I am working part time but not earning too much so that I still receive a weekly benefit?

- What are the hours for the Unemployment Hotline (603) 271-7700:

- I need help finding a new job. What are the resources available to me through the state?

-

The State of New Hampshire has launched a new jobs portal to assist job seekers connect with hiring employers located right here in New Hampshire. You can either go directly to the new jobs portal at www.nhjobs.nh.gov or just click the above button for ‘NH JOBS’.

- Weekly Work Search Requirements

-

- The department requires claim filers to conduct a weekly work search as a condition for being considered eligible for unemployment benefits.

- This requirement includes contacting hiring employers as well as conducting reemployment activities designed to prepare you for returning to work.

- More information on meeting weekly search requirements is provided during the orientation workshop.

- Some claim filers will be exempt from the work search requirement due to the circumstances of their unemployment. You should proceed as if required to satisfactorily complete a weekly work search as a condition for being eligible for benefits unless notified otherwise.

- Please monitor your correspondence for additional information.

- I work for a school. Am I eligible for unemployment benefits?

-

There have been no changes to eligibility for unemployment benefits during the summer for school employees. As in the past, if you worked for a school in the spring semester and expect to return to school employment after the summer break is over, then you are not eligible for unemployment benefits. If you worked for a school in the spring semester and have not been offered school employment in the fall then you may be eligible for unemployment benefits and should file an initial claim for benefits and follow instructions around filing your weekly continued claims. The department will need to review the circumstances of your separation from employment before being able to issue a determination as to your eligibility for benefits.

- Why does it say ‘Pay held’?

-

If there are claim issues that need to be processed on a claim to determine eligibility for Unemployment Benefits, these may require more information and time to process and payments may be held up during this time. It is important to continue to file weekly continued claims for benefits for all weeks you wish to file for during this review process.

- What if I am working part time but not earning too much so that I still receive a weekly benefit?

-

Nothing has changed regarding eligibility to file for unemployment benefits while you are working part time. You are not eligible for unemployment benefits if you are working full time. Your work and earnings from your part time employment continue to need to be reported to the department on your weekly claim. The earnings will then be reviewed to determine whether you still qualify for an unemployment benefit for each week.

- What are the hours for the Unemployment Hotline (603) 271-7700:

-

Agents stand ready on the UNEMPLOYMENT HOTLINE to answer your questions. The hotline number is (603) 271-7700. The hours of operation for the hotline are currently the following:

- Monday-Friday 8:00am-4:30pm

- Saturday CLOSED

- Sunday CLOSED