Step By Step Instructions

If you’re ready to check the status of your claim, click on Let’s Get Started. If you need assistance, please refer to the step-by-step guide below.

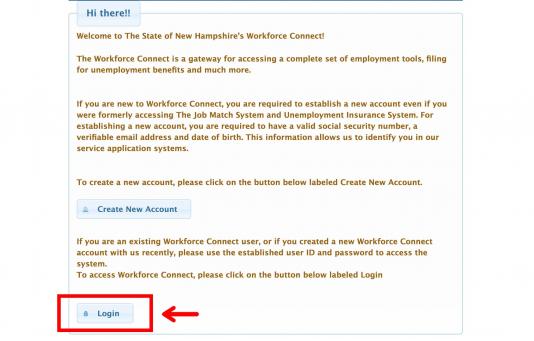

Step 1: Log In

From this welcome screen, you will need to click on “Login” at the bottom of the page. You will need your User ID and Password from your Workforce Connect account to check your existing claim status.

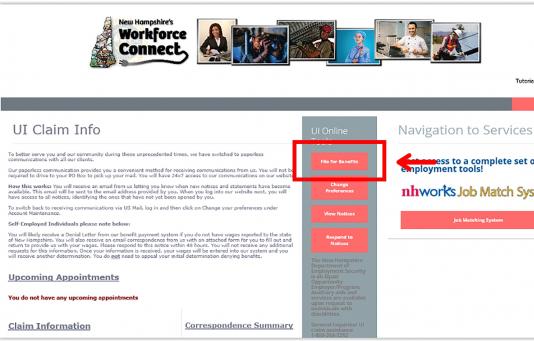

Step 2: Select “File for Benefits” Link on the Dashboard

To check the status of a claim, you need to click on one of the four salmon-colored boxes listed under UI Online Tools, including File for Benefits.

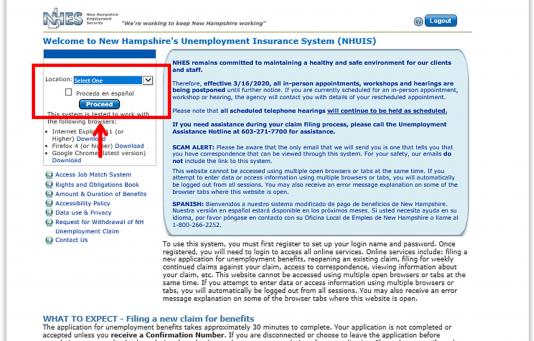

Step 3: Select Your Location

Next, you will land on the “Unemployment Insurance System (NHUIS)” page. From here, select the location from the drop-down menu on the left and then select “Proceed.”

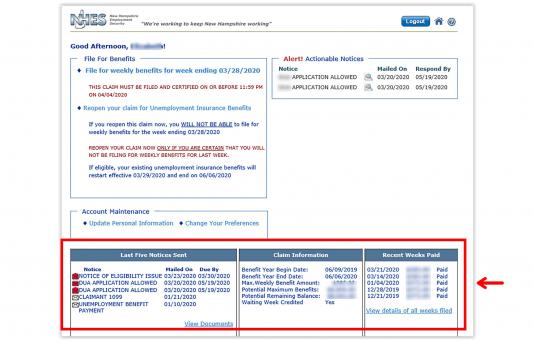

Step 4: Scroll Down to the Table

In the table at the bottom of the page, you can see the last five notices sent to you, claim information such as your benefit year and weeks that have been paid. You can also update personal information such as your name, and address and change your preferences.

Frequently Asked Questions

- I need help finding a new job. What are the resources available to me through the state?

-

The State of New Hampshire has launched a new jobs portal to assist job seekers connect with hiring employers located right here in New Hampshire. You can either go directly to the new jobs portal at www.nhjobs.nh.gov or just click the above button for ‘Covid-19 Response Recruitment’.

- Weekly Work Search Requirements

-

- The department requires claim filers to conduct a weekly work search as a condition for being considered eligible for unemployment benefits.

- This requirement includes contacting hiring employers as well as conducting reemployment activities designed to prepare you for returning to work.

- More information on meeting weekly search requirements is provided during the orientation workshop.

- Some claim filers will be exempt from the work search requirement due to the circumstances of their unemployment. You should proceed as if required to satisfactorily complete a weekly work search as a condition for being eligible for benefits unless notified otherwise.

- Please monitor your correspondence for additional information.

- How do I check the status of my claim?

-

You will be mailed a Determination of Unemployment Compensation about your monetary eligibility and, if there are any questions about your claim, you will be mailed one or more Determination of Eligibility documents about your non-monetary eligibility. This review can take time to process. You can check the status of your claim and review any notices or determinations issued to you by logging into your Workforce Connect account and clicking on the File for Benefits button to access your claim information.

- What if I moved since collecting unemployment benefits?

-

The U.S. Postal Service will not forward mail from this Agency to a claimant’s new address. For security reasons, the postal service returns all undeliverable mail to NH Employment Security. Please update your address immediately by going online and logging into your unemployment benefit account. You can also immediately access and print your own Form 1099-G from your unemployment benefit account.

- It says ‘Paid’, where is my money?

-

Unemployment benefits will be paid based on the preference you chose; either via direct deposit or paper check. Once the system shows that payment(s) have been issued, these payments still need to be sent either via the USPS if you chose mail or through your banking institution if you chose direct deposit.

- I haven't received payment yet?

-

After your initial claim is completed, it is immediately transmitted for processing. Your monetary eligibility is determined and a Determination of Unemployment Compensation is mailed that details your potential weekly benefit amount. This document is not a guarantee of payment. If there are questions on non-monetary eligibility conditions, you may be contacted for additional information. Depending on the number of questions about your claim, then this will determine the length of time it will take to process your claim. If you are found eligible, payments will be issued for any timely weeks filed at the same time the final non-monetary eligibility determinations are made. Remember to file for weekly benefits for all weeks you wish to claim for.